The best time to start is now if you’re ready. As with any of the the information I provide it because your decision to decide if you’re ready. At this point before you begin investing you might want to take a look at some of the topics on debt management and Should I Pay off my Debt or Invest? before proceeding if you still have some questions.

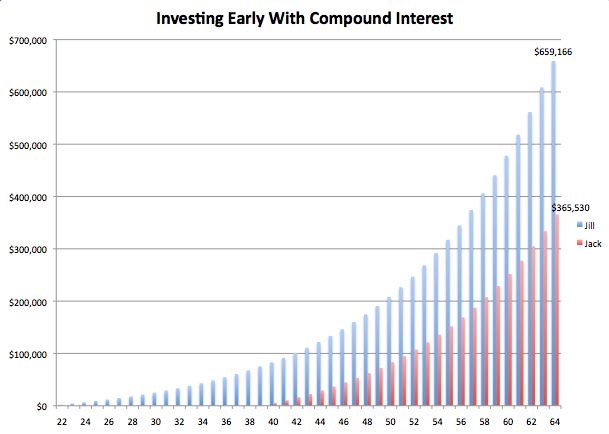

Otherwise, let me make a small compelling argument for you to get started today with investing even a small amount of money and take control of compounding interest. Below I have developed two charts to illustrate my points. The first shows Jill and Jack. Jill starts investing at age 22 right out of college and puts $2,000 per year in an investing account. Jack decides to wait and begins investing when he turns 40 after he get settled and has things a little more situated. The following assumes that each would earn and average of 8% annual return on their investment over the life of the investing.

| Name | Jill | Jack |

|---|---|---|

| Age Started Investing | 22 | 40 |

| Amount Invested | $2,000 | $5,000 |

| Total Invested | $84,000 | $120,000 |

| Account Balance at 64 | $659,166 | $365,530 |

The results are dramatic with a $293,636 ending account balance but also a $36,000 net difference in total amount invested over time. It tough to ignore the raw numbers. So I decided to take it one step further what would it take Jack to invest to catch up to Jill and here is what I found out.

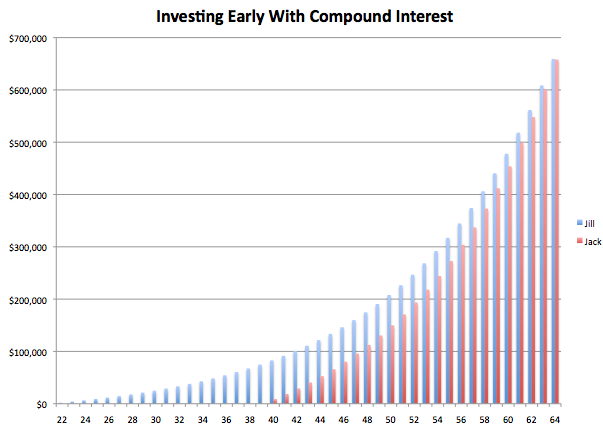

| Name | Jill | Jack |

|---|---|---|

| Age Started Investing | 22 | 40 |

| Amount Invested | $2,000 | $9,000 |

| Total Invested | $84,000 | $216,000 |

| Account Balance at 64 | $659,166 | $657,953 |

Personal Tip: It’s never too early to start investing and you can never start with too little money. When I first started investing I was setting aside $50 from each paycheck allocating to a savings account because I didn’t have enough money yet to reach the $100 threshold. Remember it’s always best to get started and adjust later. As time went on and I finally hit the $100 I moved from my savings account to a 403(b) and then as I received small increases I would increase my invest amount by $25 (from $100 to $125).